Fiscal Cliff Debate Appears to Rattle Overall Economic and Financial Confidence

WASHINGTON, Jan. 7, 2013 /PRNewswire/ -- Consumer confidence in the housing sector grew last month, marked by continued positive attitudes toward home price, rental price, and mortgage rate expectations, according to Fannie Mae's December National Housing Survey results. The growing belief held by Americans that these housing indicators will climb in 2013 may inspire a boost in home purchase activity during the coming months. However, while consumers seem confident that housing activity is on the rise, their outlook toward the economy and personal finances appears to have resumed a more unsettled trend following a show of optimism in November.

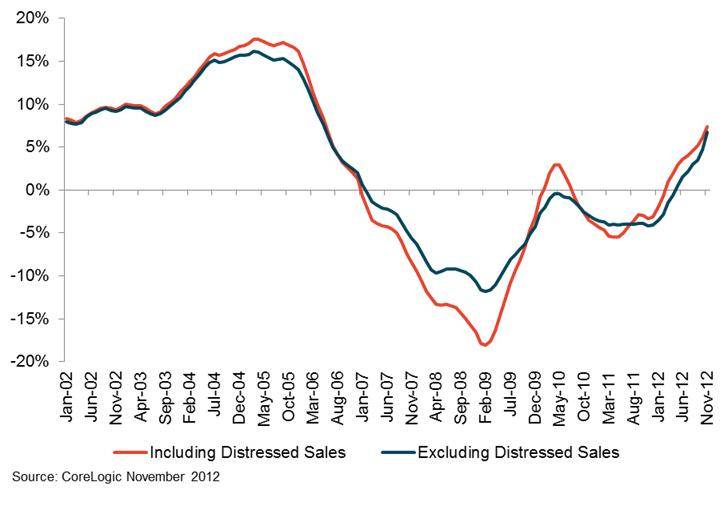

"The highest share of consumers in the survey's two-and-a-half-year history expect home prices to increase in the next 12 months. This view is consistent with Fannie Mae's expectation that home prices will rise going forward on a national basis. Combined with consumers' growing mortgage rate and rental price increase expectations, the positive home price outlook could incentivize those waiting on the sidelines of the housing market to buy a home sooner rather than later and thus support continued housing acceleration," said Doug Duncan , senior vice president and chief economist of Fannie Mae. "Despite continued strengthening in the housing market, consumers' concerns over the fiscal cliff and debt ceiling have caused considerable volatility in their perceptions of the larger economy. This uncertainty seems to be prompting a growing share of consumers to expect their personal finances to worsen and may contribute to weaker near-term economic growth."

SURVEY HIGHLIGHTS

Homeownership and Renting

- The average 12-month home price change expectation jumped to 2.6 percent, the highest level since the survey's inception in 2010.

- At 43 percent, the share who believe home prices will go up in the next 12 months reached the highest level recorded, up 6 percentage points over November.

- The percentage who think mortgage rates will go up continued to rise, increasing by 2 percentage points to 43 percent, the highest level since August 2011.

- Twenty-one percent of respondents say it is a good time to sell, a 2 percentage point decrease from last month's record high, but a 10 percentage point increase year over year.

- At 4.4 percent, the average 12-month rental price expectation hit the highest level since the survey's inception, up 0.4 percent over last month.

- Forty-nine percent of those surveyed say home rental prices will go up in the next 12 months, a slight increase from last month.

- The share of respondents who said they would buy if they were going to move decreased slightly to 66 percent.

The Economy and Household Finances

- At 39 percent, the share of respondents who say the economy is on the right track fell by 5 percentage points from last month's survey high.

- The percentage who expect their personal financial situation to get worse over the next 12 months continued to rise, reaching 20 percent and the highest level sinceAugust 2011.

- Twenty-two percent of respondents say their household income is significantly higher than it was 12 months ago, a slight increase over last month and a 5 percentage point increase over September.

- Thirty-seven percent reported significantly higher household expenses compared to 12 months ago, a 3 percentage point increase over the past month and the highest level since December 2011.

The most detailed consumer attitudinal survey of its kind, the Fannie Mae National Housing Survey polled 1,002 Americans via live telephone interview to assess their attitudes toward owning and renting a home, mortgage rates, homeownership distress, the economy, household finances, and overall consumer confidence. Homeowners and renters are asked more than 100 questions used to track attitudinal shifts (findings are compared to the same survey conducted monthly beginning June 2010). Fannie Mae conducts this survey and shares monthly and quarterly results so that we may help industry partners and market participants target our collective efforts to stabilize the housing market in the near-term, and provide support in the future.

For detailed findings from the December 2012 survey, as well as a podcast providing an audio synopsis of the survey results and technical notes on survey methodology and questions asked of respondents associated with each monthly indicator, please visit the

Fannie Mae Monthly National Housing Survey site. Also available on the site are quarterly survey results, which provide a detailed assessment of combined data results from three monthly studies. The December 2012 Fannie Mae National Housing Survey was conducted between December 3, 2012 and December 18, 2012. Interviews were conducted by Penn Schoen Berland, in coordination with Fannie Mae.

Opinions, analyses, estimates, forecasts, and other views of Fannie Mae's Economic & Strategic Research (ESR) Group included in these materials should not be construed as indicating Fannie Mae's business prospects or expected results, are based on a number of assumptions, and are subject to change without notice. How this information affects Fannie Mae will depend on many factors. Although the ESR Group bases its opinions, analyses, estimates, forecasts, and other views on information it considers reliable, it does not guarantee that the information provided in these materials is accurate, current, or suitable for any particular purpose. Changes in the assumptions or the information underlying these views could produce materially different results. The analyses, opinions, estimates, forecasts, and other views published by the ESR Group represent the views of that group as of the date indicated and do not necessarily represent the views of Fannie Mae or its management.

Fannie Mae is a leading provider of mortgage credit in the United States. We guarantee and purchase loans so that families can buy homes, refinance their existing mortgages, or access affordable rental housing. Fannie Mae is focused on assisting homeowners in distress, stabilizing neighborhoods, and encouraging sustainable lending. We are committed to improving our financial condition and our priorities are aligned with the public interest. Our work supports the housing recovery today and is helping to build a better housing finance system for the future.

SOURCE Fannie Mae

PR Newswire

PR Newswire (

http://s.tt/1y3sT)

PR Newswire (http://s.tt/1yDug)

PR Newswire (http://s.tt/1yDug)

PR Newswire

PR Newswire PR Newswire

PR Newswire