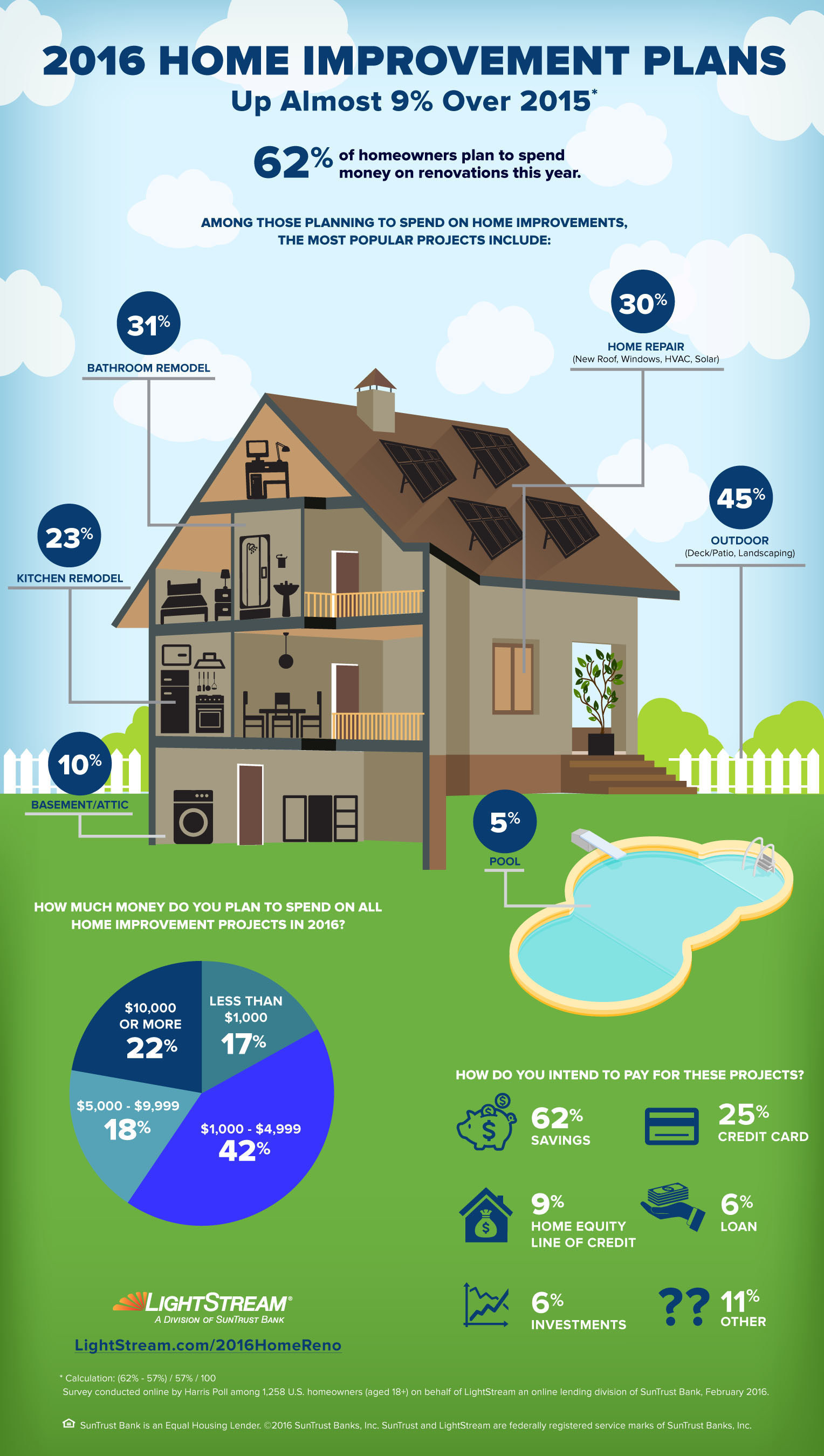

As the remodeling market continues to improve, more homeowners are taking on home renovation and maintenance projects and are open to spending even more money than last year. According to its third annual survey, LightStream, the national online lending division of SunTrust Banks, Inc. (NYSE: STI), found 62 percent of homeowners plan to spend on home improvement projects in 2016, an increase of almost nine percent compared to 2015.* The survey of homeowners was conducted online by Harris Poll in February 2016.

The amount that homeowners are looking to spend has also increased from years past. Overall, homeowners planning renovations this year will spend an average of $6,239 as compared to $5,037 in 2015. Forty percent plan to spend $5,000 or more (up from 36 percent in 2015) and 22 percent plan on spending $10,000 or more (up from 18 percent last year).

Once again, the desire to update a home's look, features and technology is the main motivation to remodel. The trend in outdoor living continues to dominate as the number one home improvement project with 45 percent investing in decks, patios or landscape renovations. Bathroom remodels (31 percent); upgrades to roofs, windows, HVAC and other technology systems (30 percent); and kitchen remodels (23 percent) round out the top four projects.

Sixty-two percent of homeowners planning renovations will pull from their savings. Credit cards will be used by 25 percent of homeowners; home equity lines of credit (9 percent), loans (6 percent) and investments (6 percent), are also cited in homeowner payment strategies.

According to research analysts at the Remodeling Futures Program at the Joint Center for Housing Studies of Harvard University, the challenge for 2016 will be whether the industry can find solutions to ongoing hurdles, such as consumer financing concerns. †

"Home remodeling costs are often paid for with savings," said Todd Nelson, LightStream business development officer. "But as homeowners explore remodeling options, the scope of their renovation often grows. It's always important for people not to overextend themselves on any project. However, financing can be a great solution to supplement a budget, without incurring more expensive credit card debt or having to tap into investments. A home improvement loan or home equity line of credit can be a smart option, as today's continued low interest rates can underpin additional expenses and allow people to take advantage of the cost, time and labor efficiencies of doing their projects all at once."

No comments:

Post a Comment